Time to earn £180,000 - £210,000 a year from your fee income of £300,000 a year.

Are you aware of the draw offered by the leading Independent firms in the UK?

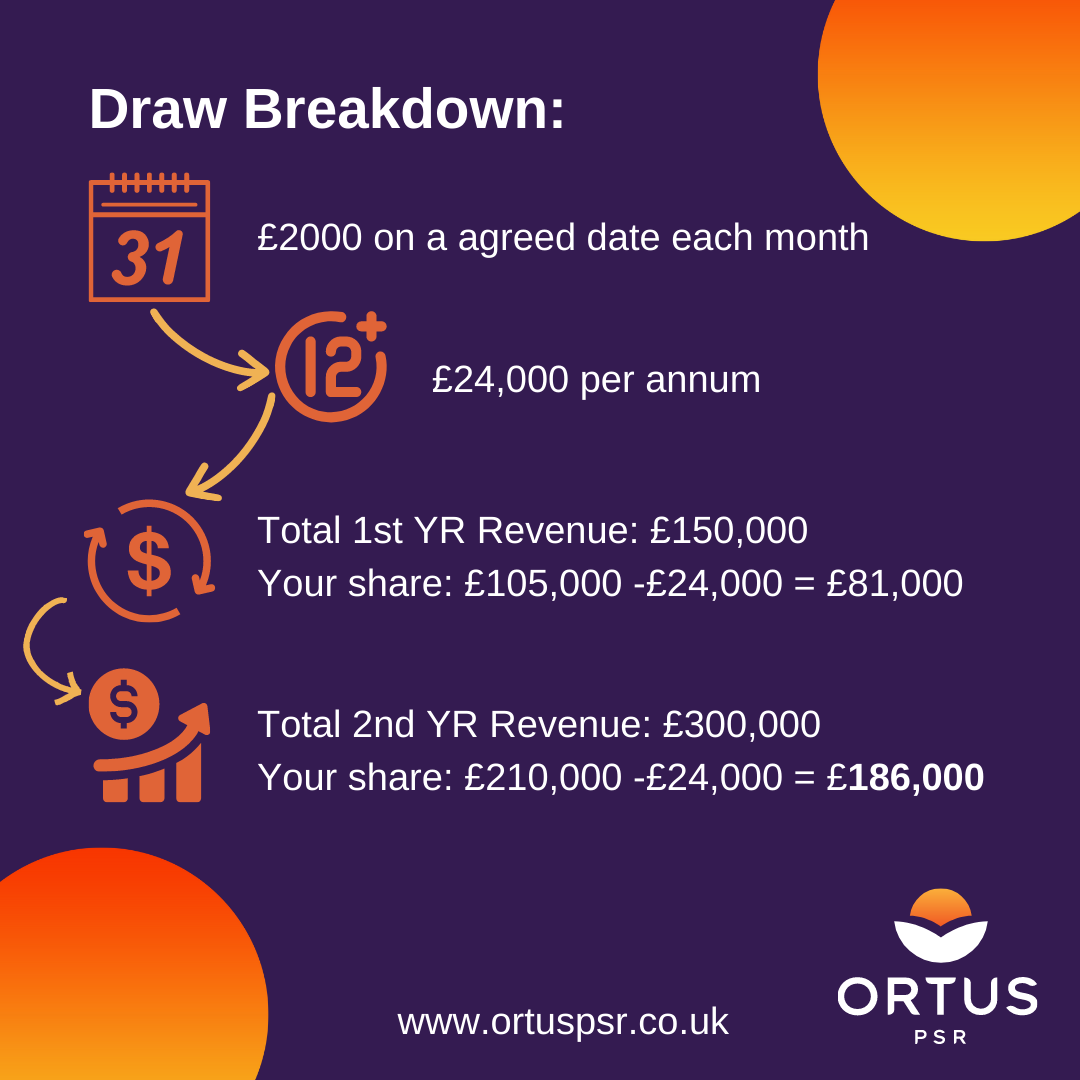

Below is a simple breakdown of how a draw works, I used this example based on a 70/30 profit share split, in favor of the Adviser. Payback varies with each company, most operate a payback of profit share so a percentage of the loan would come off each time you take your cut from your billed business. In the example below the £2,000 a month is your take-home net.

As you can see, a draw can be a really simple solution to enable you to build your business under a fantastic brand and still cover your cost of living, and we can all agree with those costs rising daily there is an underlying pressure none of us need. Plus, by year 2 you will likely be earning more than you could ever be earning in an employed role with annual fees at £300K, with the goal to be that by year 3 you won’t need a draw and can continue to grow your business and enjoy the majority of revenue earned. Imagine those numbers when your annual revenue increases – the skies the limit!

Let’s face it, as a successful Adviser it is a daunting process to wade through the job market right now. There are all kinds of options that companies scrambling for Wealth Managers & Advisers, with solid experience and a decent client following, are advertising that it may seem overwhelming to choose which one is right for you.

More and more companies these days are offering a self-employed partnership proposition, which vary in detail for each company but tend to all have the same opportunity for you to create a better work / life balance, the freedom to choose the best products and services to fit for your clients’ needs, an uncapped profit potential and give you control to build your business with a support system and brand already in place.

If you are confident that your relationships with your clients will outlast any covenants that you need to abide by, know you have the business development skills and drive to build your book and yearn to have a more client facing role, then the self-employed route should be a no-brainer for you.

To some, however, I understand that could seem like an intangible dream if you have financial commitments and/or are the main bread winner for your home. Having that safeguard of a regular salary may seem like a non-negotiable to even consider self-employment from the start.

But what if I told you there was a way, with a no interest, tax free draw / loan?… I can hear the gasps, rolling eyes and shaking heads from here… “ What? A LOAN?!!!!!” the horror!…And I know, I know, as a Financial Advisor, a loan to you may feel like a bad option, what some would consider as starting a business ‘in debt’. But that shouldn’t be the way to look at it. A draw is simply a way for you to be able to build your business without the stress of worrying about home bills, allowing you to completely focus on your business productivity.

How the amount of the monthly draw is decided varies from company to company; some offer you a fixed amount based on the revenue expectations outlined in your business plan.

A draw benefits both you and the company, they are not doing you a favour by offering you one, as it is a much cheaper option than employing someone with all the associated costs.

You should be free to build your book for at least 2 years without worry, as higher-end, reputable companies understand you’ll have restrictions through the first year and will respect those.

To learn more contact us today to talk through your options and get introduced to IFA firms that can help you transition today.

Consultants that can help:

James Ackland, email: james@ortuspsr.co.uk

Angie Kober, email: angie@ortuspsr.co.uk

Steve Auburn, email: steve@ortuspsr.co.uk

Our office line is: 0333 011 2822